67 - Your $50 decline just cost you $5,050

Fraud prevention costs you more than you think.

Why? Because of false positives.

“Oh, geez, thanks Chen! Please enlighten me - what are false positives?” /eyeroll

Yeah, alright - bear with me for a second. By false positives I don’t mean how much revenue you’ve lost on that blocked transaction. I mean how much you impacted the customer’s total lifetime value (LTV).

“Oh, wow! I didn’t think of that before, thanks once more!” /eyeroll

Maybe you baked LTV into your FPR impact already. If so, you’re already leading the pack.

But not all declines are made equal. Some declines might cost you more LTV than others.

Which customer segments are you bleeding the most from? Two stand out.

The populations that punish you for friction

New customers are brutally unforgiving.

When you decline someone in their first transaction or two, there's no loyalty yet, no sunk cost, no reason to give you a second chance.

Churn rates in that population change from business to business, but can easily spike above 50%. When I was working for PayPal, it wasn’t uncommon to see that with merchants.

When you compare that to how well established customers react to fraud-related friction, the difference is significant.

Established accounts behave differently among merchants, but anything between 2x and 6x less churn than with new customers should be the normal range.

The reasons are the same as for new customers, just reversed - they’ve already established loyalty with your brand, so they are more forgiving.

High spenders carry the same forgiveness as established customers. However, their high LTV amplifies every mistake.

To illustrate, let’s assume you define high spenders as customers who spend 10x your average customers over their first year.

Even if they are 2x-6x more forgiving of risk friction, their churn rates would still put you at a net negative.

What a decline actually costs you

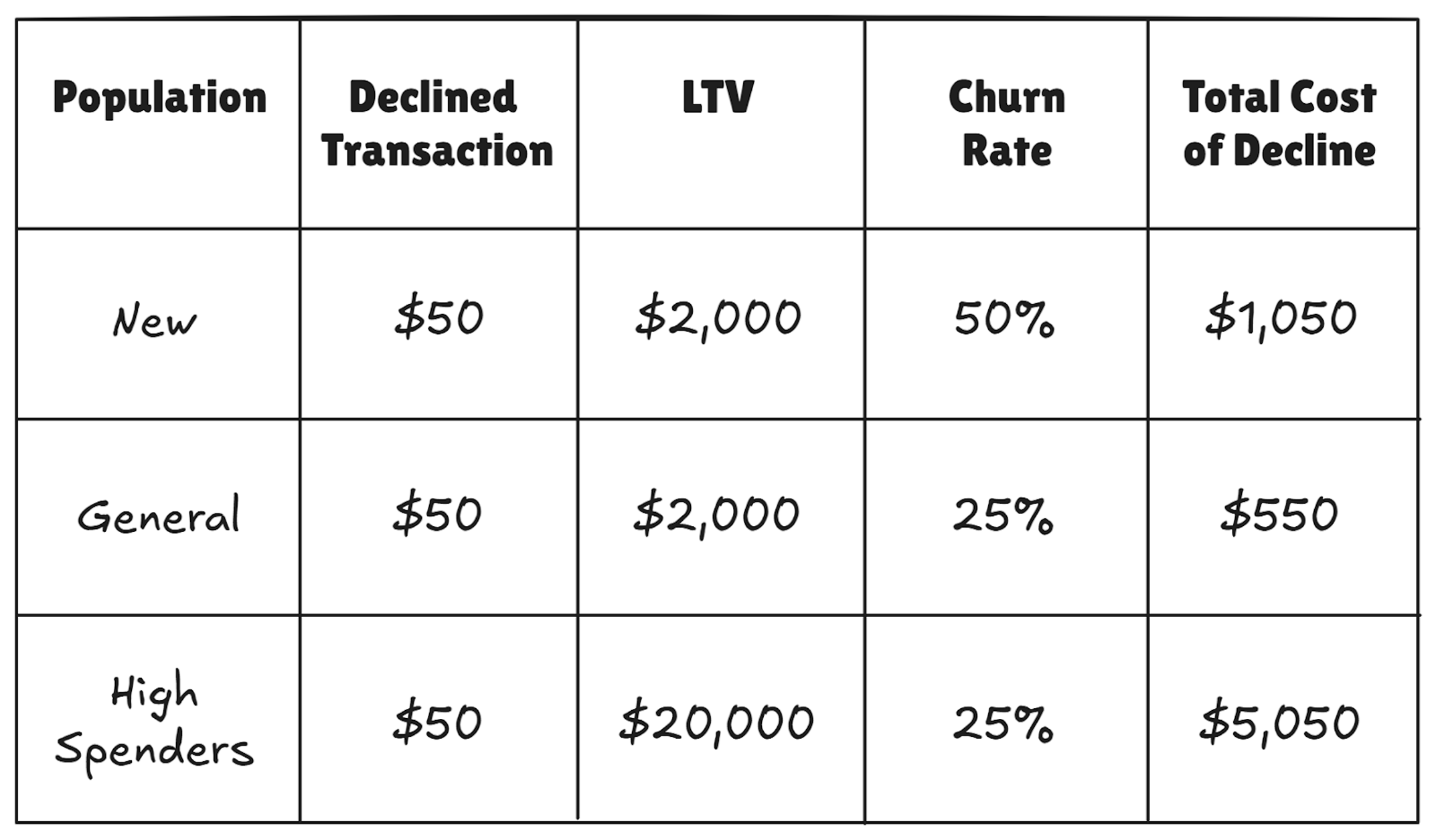

Let’s take a look at the table below to put these numbers in context (taking into account a conservative 2x factor for new customer churn):

What does it tell us?

Even though we are declining only a $50 transaction, the total LTV cost is at least 11x higher.

The LTV impact is even worse for the two populations we identified.

Side note: As I stated, while these assumptions are likely to be true for all businesses, the figures themselves would look different for each company.

The point shouldn’t be that new customer declines cost you $1,050, but that you should research and come up with your own definitions for these populations. For example:

How do you define a new customer decline? Is it their first transaction only, or the third one as well?

How do you define a high spending customer? By them spending 10x in their first year compared to average? 5x in the first two years?

How do you even calculate LTV for your customers?

Side note: For that last one, take a look at the LTV in-depth research and guide from HubSpot.

It’s a bit of homework, but the insights you’d gain about your customers and business as a whole would be invaluable.

Having clear and tailored population definitions would also set you up for the next question - what should you do about it?

How to treat friction-sensitive populations

Consider applying these changes to your fraud strategy:

First, segment your thresholds.

This one is pretty easy. Once you have a better grasp of your ROI and how it differentiates among the segments, all you need to do is expose these segments to your risk engine.

Side note: High spenders can be managed through an “approve list”. New customers can be flagged as such with an account-level flag that decays automatically after X transactions or Y days.

Once you’ve done that, the exercise of optimizing the decline threshold becomes pretty straightforward. Instead of looking at the transaction-level economics, you take into account the LTV ones.

Second, soften your controls for these segments.

This is mainly true for your high spenders population, as they are usually low-risk accounts (versus new customers who are always higher-risk than average).

Softer controls mean higher velocity limits, fewer mandatory verification steps, and faster approval flows.

Third, A/B test your new strategy.

Remember how your CFO always complains that fraud is a cost center that doesn’t positively impact growth? Here’s your chance to prove them wrong.

Implement these measures for 50% of the population, and track how LTV develops over time.

After a couple of months, you’ll be able to show not only that you understand the business fundamentals and are committed to helping it grow - but that you’re also actively doing so.

Guaranteed.

The bottom line

Want to grow your business?

It’s pretty simple:

Stop measuring FPR as a trade-off between fraud losses and declined revenue. Instead, start measuring the trade-off between losses and customer total lifetime value.

Your fraud model should continue to detect fraud patterns, but your strategy should take into account LTV in its ROI calculations.

Identify friction-sensitive populations and implement white-glove treatment that optimizes for LTV growth.

And that's how you turn fraud prevention into a profit center.

Are you considering LTV when making risk decisions? Hit the reply button and share your experience with it.

In the meantime, that’s all for this week.

See you next Saturday.

P.S. If you feel like you're running out of time and need some expert advice with getting your fraud strategy on track, here's how I can help you:

Free Discovery Call - Unsure where to start or have a specific need? Schedule a 15-min call with me to assess if and how I can be of value.

Schedule a Discovery Call Now »

Consultation Call - Need expert advice on fraud? Meet with me for a 1-hour consultation call to gain the clarity you need. Guaranteed.

Book a Consultation Call Now »

Fraud Strategy Action Plan - Is your Fintech struggling with balancing fraud prevention and growth? Are you thinking about adding new fraud vendors or even offering your own fraud product? Sign up for this 2-week program to get your tailored, high-ROI fraud strategy action plan so that you know exactly what to do next.

Sign-up Now »

Enjoyed this and want to read more? Sign up to my newsletter to get fresh, practical insights weekly!

![Native[risk]](http://images.squarespace-cdn.com/content/v1/65704856a75e450a6d17d647/f3aa0ca7-8a4d-4034-992f-9ae514f1127e/Native+risk_logo-invert.png?format=1500w)