#59 - The AI mistake fintech leaders keep making

I find most conversations about AI in Risk to be naïve.

“We can now automate… things!”

I mean yeah, but automation is not new in any way. We just used other means before: rules, machine learning, and not to mention–code.

“We can now be more efficient!”

Yes, but that is missing the point. If you’re wondering how AI is going to make you more efficient, you already lost the race.

Give me 4 minutes and I’ll convince you why.

Efficiency is capped. Low.

Here’s the thing about optimizing for efficiency: your ROI will be severely limited.

If you have a process that takes 1 hour, you can only optimize it to save 1 hour. Best case.

If you have a team of 3 FTEs, you can only “optimize” 3 FTEs. Best case.

In most cases, the limit of what can be achieved isn’t groundbreaking when you think of it. Yes, it can save you money, but can it revolutionize your business?

Not a lot of companies can claim that, and even less so in the fintech space.

But that’s just the half of it.

The thing with optimization is that it generally follows the Pareto Principle, widely known as the 20/80 rule: you can achieve 80% of the desired outcome with 20% of the effort.

When you get into advanced optimization, effort spikes exponentially. With diminishing returns, the ROI shrinks and the effort is abandoned.

And yes, believe it or not, that happens even when you use AI.

But the real irony? The first 80% are so easy to automate that it’s very likely that you already did that using a different tech.

Am I saying that Risk teams should not leverage AI? No.

Am I saying you should not leverage AI for automation? No.

I’m simply saying that by doing that, you’re thinking inside the box, which usually doesn’t lead to extraordinary results.

So what should you be leveraging AI for?

Unlocking new capabilities

“Net new” isn’t capped.

Being able to do things you weren’t able to do before isn’t capped. I am not talking about being faster at X. I am talking about being able to do X.

When you do new things, the 20/80 rule suddenly works in your favor.

And best of all, you’re not limited to how many new capabilities you develop, so you can repeat this investment for compounding effects.

AI can automate and create efficiencies. But better yet–it can substitute knowledge or skillsets you don’t have at all.

Here’s an example:

Let’s say your Risk team is operational in nature and relies heavily on manual reviews and investigations (like most teams out there).

To gain efficiency, you can implement an AI co-pilot that expedites reviews and enables you to cut headcount. Great.

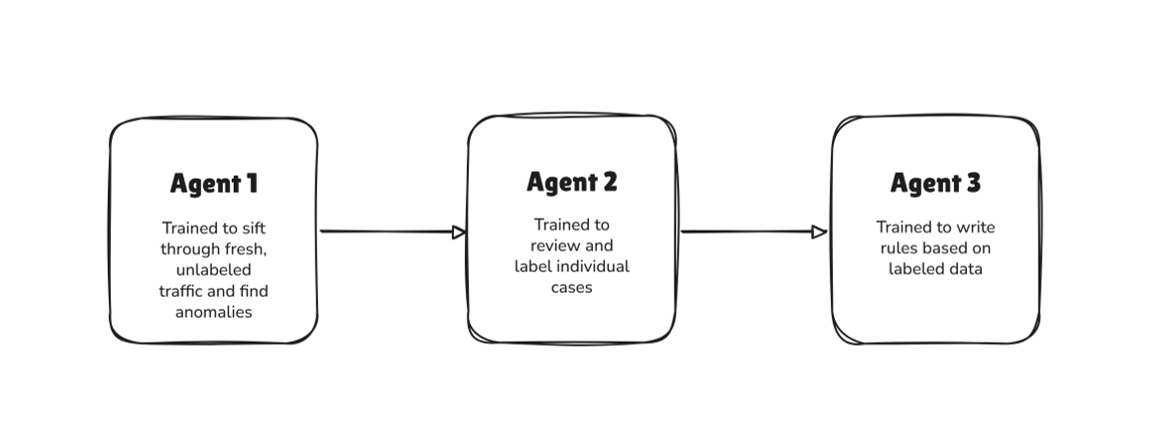

But what if you take that exact same agent, and have it review and label pattern anomalies detected by a second AI agent?

And what if, based on a new fraud pattern that this agent just labeled, you implement a third AI agent to write a rule that blocks it?

Not only that identifying such patterns quickly will reduce the need for manual investigations (there’s your efficiency gains), you’re also likely to reduce losses because you can now operate in real time.

That’s a “net new” capability.

And you don’t need to hire a single data scientist to achieve that.

Uncovering unknown unknowns

To quote the infamous Donald Rumsfeld:

Here lies AI’s own catch-22. If doing “net new” is the best path for high ROI, and if “net new” is, by definition, things you’re not doing right now–how can you even know what these things are?

If you have an Ops-only team, how would you even think about automating the anomaly detection agentic workflow depicted above?

The answer is to talk to other human beings. Here are some ideas:

Peers: It’s very likely you know some of your peers in similar companies. At the same time, it won’t be surprising if their organization is built or is operated differently. Sharing tactics around how to fight fraud is always mutually beneficial and can expose things your organization isn’t aware of.

Risk vendors: Your vendor likely has a deeper understanding of how to leverage technology for risk management. It’s not whether they have AI agents or not, but it’s about them informing you on advanced tactics you haven’t thought about.

Industry experts: At any given moment, each industry niche has its own collections of risk experts that are open for consulting. Again, they don’t need to be AI experts, they should mainly inform you of methodologies and processes you’re currently not leveraging.

Your team: You’ll be surprised how much you can learn from your own team, including the most junior members. What they lack in experience, knowledge, or skills, they compensate for with intimate knowledge of your business and the motivation to make it better.

Side note: Here are some ideas to get you started.

My 4 minutes are up

Here’s what I’m trying to say:

AI can be a faster carriage. Nothing wrong with that.

But you can also make it a car.

Guess which teams are going to win.

Are you convinced yet?

Are you already using AI agents in your risk management environment? I’m very curious to hear of how teams are pioneering this tech in-house. Hit reply and let me know!

In the meantime, that’s all for this week.

See you next Saturday.

P.S. If you feel like you're running out of time and need some expert advice with getting your fraud strategy on track, here's how I can help you:

Free Discovery Call - Unsure where to start or have a specific need? Schedule a 15-min call with me to assess if and how I can be of value.

Schedule a Discovery Call Now »

Consultation Call - Need expert advice on fraud? Meet with me for a 1-hour consultation call to gain the clarity you need. Guaranteed.

Book a Consultation Call Now »

Fraud Strategy Action Plan - Is your Fintech struggling with balancing fraud prevention and growth? Are you thinking about adding new fraud vendors or even offering your own fraud product? Sign up for this 2-week program to get your tailored, high-ROI fraud strategy action plan so that you know exactly what to do next.

Sign-up Now »

Enjoyed this and want to read more? Sign up to my newsletter to get fresh, practical insights weekly!

![Native[risk]](http://images.squarespace-cdn.com/content/v1/65704856a75e450a6d17d647/f3aa0ca7-8a4d-4034-992f-9ae514f1127e/Native+risk_logo-invert.png?format=1500w)